It’s long been said that to be successful, you must go where the business is. For 3PLs, the business for parcel shipping is just about everywhere, and it is growing.

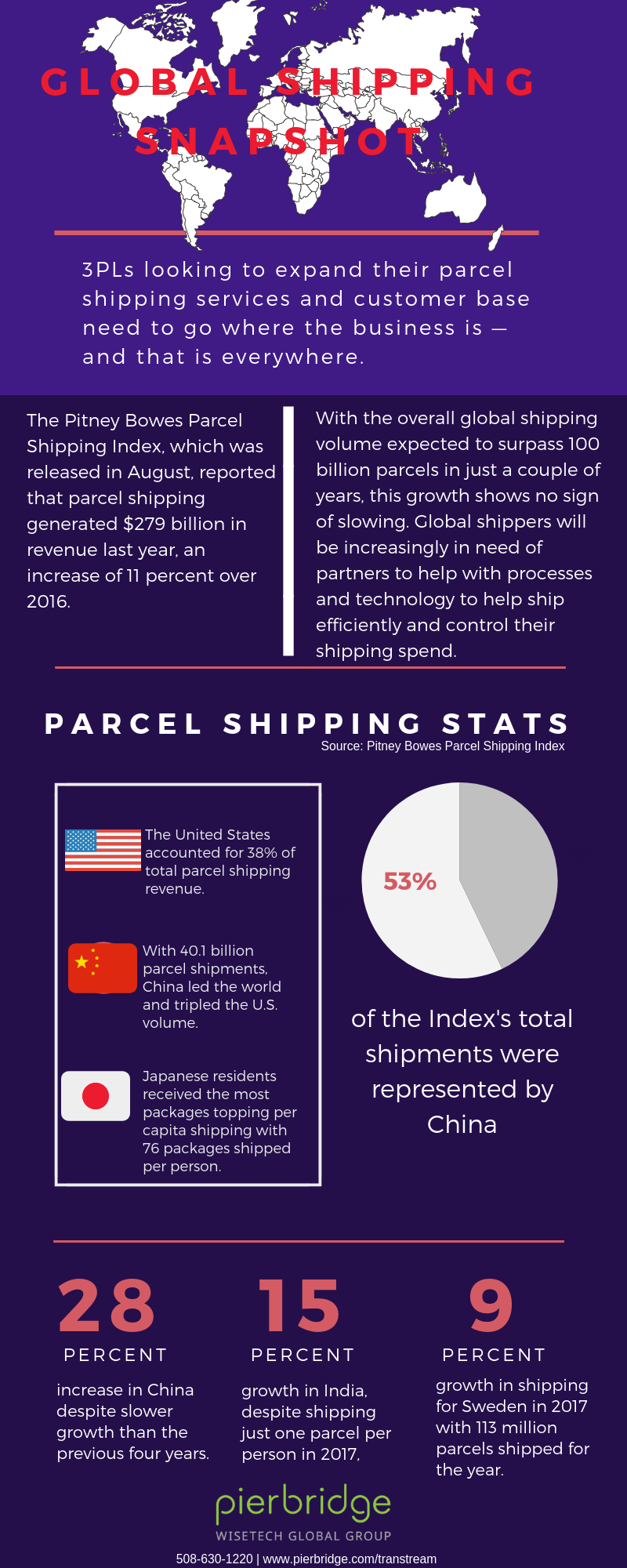

eCommerce is not constrained by national borders so shipping is now more than ever an international game filled with its own trials and tribulations. And that isn’t about to change based on reports in Pitney Bowes’ Parcel Shipping Index, which was released in August. The report indicated that parcel shipping generated $279 billion in revenue last year, an increase of 11 percent over 2016, and is expected to top 100 billion parcels shipped by 2020.

This means 3PLs, freight forwarders, and other logistics intermediaries will increasingly need to expand their services to encompass first-mile, cross-border, and last-mile delivery, or lose out on riding the parcel tsunami wave.

As expected, the United States led in parcel revenue, accounting for 35 percent of the total revenue of the 13 countries examined. However, China was responsible for a whopping 40.1 billion parcels shipped, outpacing the U.S. which came in with 11.9 billion, and Japan in third place with 9.6 billion. China’s 28 percent growth in 2017 helped propel the industry’s parcel volume to 74.4 billion, a 17 percent jump over 2016’s 63.6 billion.

“China continues to have the greatest impact on the growing shipping market,” said Lila Snyder, President, Commerce Services at Pitney Bowes, in a release about the study. “Globally, ecommerce continues to drive growth in all regions. Global ecommerce giants continue to raise the bar, resetting customer expectations when it comes to shipping. As retailers and marketplaces look to cross-border commerce to drive growth, carriers must create efficient, seamless routes to market.”

While these traditional growth markets topped many of the study’s lists, there was growth in just about every one of the 13 researched.

According to the study, Brazil saw a 6 percent growth in 2017, while Canada came in at 5 percent growth year-over-year. Sweden led the way in European growth at 9 percent while Norway was the lone country to see shipping slip, with a 1 percent decline compared to 2016.

In all, parcel shipping is trending up globally, and it is expected to keep growing as technology continues to make shopping and shipping easier from computers, tablets, and phones. The growth for shippers means there is room for growth for those that help them do their business better through planning and enterprise parcel shipping software to help them navigate the choppy international waters.